Data Markets for Digital Agriculture

One goal of the digital agriculture project is to empower farmers to participate in a digital farming ecosystem via a data sharing marketplace. In the proposed system, farmers collect and share farming data on a data sharing platform. By leveraging farmers’ data, including interventional data on the outcomes of different fertilizer applications, the data platform will provide crop yield predictions, technology recommendations, and credit risk assessment. Overall the system incentivizes farmers to participate in a data sharing marketplace by enabling access to credit and technological upgrades that increase crop yield and profit. In this project, we address the problem of how to fairly compensate farmers for their data, as well as how to optimally allocate data-based recommendations to farmers who interact in a downstream market for crops.

PROJECT HIGHLIGHTS

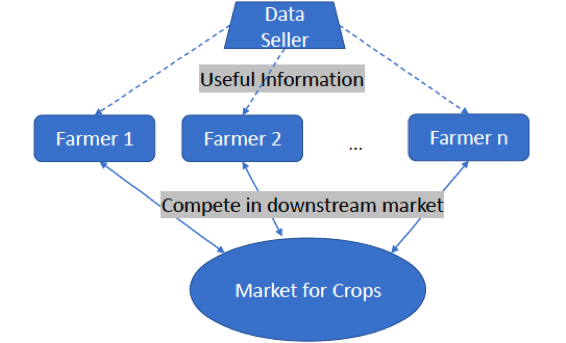

We consider the case of a monopolistic data seller selling data or data-based recommendations to farmers, where such recommendations allow farmers to increase their downstream profits. Allocations of data generate negative externalities between the farmers because they compete in a downstream market.

By placing the model into an auction framework, we answer the question: Given this competition structure, how should a data seller allocate and price data or data-based recommendations to the farmers in order to maximize social welfare or the data seller’s expected revenue?

KEY FINDINGS

- When data sets are used to improve the accuracy of a given prediction task, we can reduce the combinatorial problem of allocating and pricing multiple data sets to the auction of a single digital (freely replicable) good.

- The welfare-maximizing mechanism for allocating data sets to farmers with negative externalities (due to competition in the market for crops) features a thresholding allocation rule which weighs the value gained versus the externality caused by each farmer if allocated the data.

- The revenue-maximizing mechanism for selling data sets to farmers with negative externalities features a similar thresholding rule, but now uses transformed virtual values analogous to those used in the standard Myerson optimal auction.

RELATED PUBLICATIONS

Anish Agarwal, Munther Dahleh, Thibaut Horel, and Maryann Rui. Towards data auctions with externalities. Accepted in NetEcon (The 15th Workshop on Economics of Networks, Systems, and Computation), arXiv preprint arXiv:2003.08345, 2020.s